“The system should be in a state where you can spin up the whole process and go through a full financial plan at any point of the year, on demand, without having to rebuild any templates or processes.”

Continuous Planning

Finance professionals intuitively understand the problem with going through the planning process only once in a year. You create and finalize the budget by November or December and by the time February or March roll around, it’s already starting to look irrelevant. We’re all experiencing it at the moment: every 2020 budget is obsolete, and I don’t need to expound on why that is. Business changes frequently. Certainly it changes more frequently than once every 12 months, and rarely does it change just in time for the arbitrary start of the annual planning cycle. Rolling forecasts and frequent reforecasting is an important capability of any FP&A team.

The Benefits

There are a number of benefits to forecasting 4+ times per year, some more obvious than others:

- You can quickly adapt to changing conditions. If you can quickly see that the sales forecast is soft, you can hold off on producing more inventory or you can ramp up marketing campaigns to make up for it compensate. If you see the company as a whole is forecasting high operating costs relative to revenue, you can quickly put austerity measures in place or you can get ready to bring on debt earlier than you initially planned.

- Your existing methods get better. Since your corporate planning process is no longer something you dust off and use once per year, you’ll get better at it through practice incremental improvements. You’re more likely to work up the motivation to squash little problems or modeling bugs because you’re just going to encounter them again next month or next quarter.

- If you choose to stick with the traditional Annual budget process, you’re not starting from scratch. You have a recent and still-relevant plan as a starting point. Annual operating budgets can be started later in the year and can be completed quicker.

- It establishes a planning culture throughout the organization. Especially if you choose to include groups outside of Finance, your stakeholders will naturally provide better input if they’re required to participate throughout the year: (a) They haven’t forgotten everything since last year and (b) planning becomes just part of working here and we do it year-round. When there is some sort of external event that affects your firm, being able to spin up the whole system and generate a new plan is invaluable.

Two reasons come to mind for why this hasn’t been more common until now:

- It takes too much time and effort to reforecast. There is a lot of work involved to retrieve the latest actuals, collect feedback from the organization, and then update the latest forecast. It takes FP&A teams away from other high-value activities and the results aren’t necessarily timely.

- It’s not valued. I usually see this in companies where things are going really well. I once worked with a company where the CFO would take an evening once per year and write up a high-level annual budget entirely on his own; the finance equivalent of writing a financial plan on a cocktail napkin. That process suddenly had to change when a larger company came in to acquire them!

FP&A Technology

The key to overcoming these challenging is with the adoption of FP&A technology (you also require executive support and good change management practices, among other things, but let’s cover the easy stuff first for now).

First, all FP&A software will give you the basics to make this far easier than it would be to do this the old fashioned way with Excel and e-mails and linked spreadsheets. All solutions aggregate data, they standardize templates and allow users to input directly, they all automate your data load process, and they all give you visibility and transparency across the process. If you’d like to learn more about core FP&A software features, head over to our Budgeting & Forecasting page and review the Before/After visuals.

Let’s point out some of the nuanced features your software needs as well:

-

- Centralized “date” drivers and the ability to roll the whole system forward. All your input templates and load processes should roll over to the next planning period without manually adjusting each one. When using a planning template, the previous forecast month(s) should automatically be replaced with actuals.

- Input sheets and forms that can easily span across fiscal years. This may seem like a simple feature but some systems suffer from the same “fiscal year bias” that led to static annual planning in the first place and aren’t structured this way.

- A workflow process with relative due dates so that you don’t need to manually revise each task date once the process restarts. It’s especially effective if it recognizes weekends and aligns the revised dates to weekdays accordingly.

- A role or group-based security permissions model where access to tasks and forecast components are controlled through central groups instead of through named users. Named individuals move between departments or leave the company all the time. To reduce manual effort, the “HR Administrator” should be assigned to the five different HR tasks, rather than “Joe Smith”. When “Joe Smith” is replaced with “Mary Sue”, you remove Joe from the HR Administrator role and add Mary. One change instead of five.

- The ability to simplify and automate inputs for your annual plan and make them lite-touch. You may want to go through a very detailed planning process for certain components on an annual basis, but then scale it back with a lite-touch monthly process at the same time. This will be helpful where parts of the plan aren’t worth diving into extreme minutiae and instead you want to roll with.Two examples:

Example 1: Where the annual plan is by unique GL account, but the monthly forecast is at the summary account.

Example 2: You may want to automate part of the plan and apply a 3% increase to a set of accounts or departments. There are huge benefits here if your software can easily apply statistical modeling or predictive analytics to certain GL accounts. - The ability to combine your current tactical forecast and your longer term strategic plan. You may want to combine a short-term tactical plan alongside your long-term strategic plan and this should be seamless with the software.

As a final general rule of thumb, the system should be in a state where you can spin up the whole process and go through a full financial plan at any point of the year, on demand, without having to rebuild any templates or processes. I always strive for this when implementing any planning system.

How often should you plan?

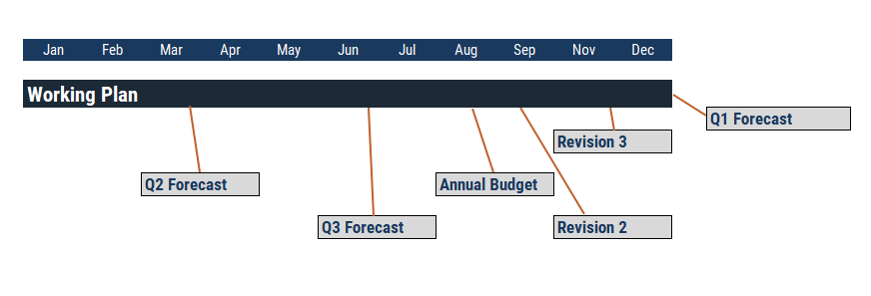

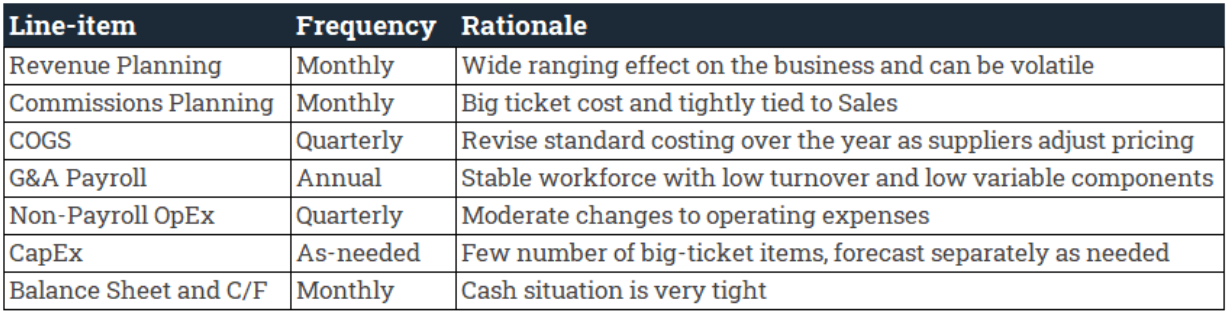

Of course, the answer here depends on your business. You can tailor this to your business across two dimensions. Your frequency could be annually, quarterly, monthly, weekly, daily, or anything in between. You can and should also separate these out by the financial line-item, where high-impact, high-variance items are planned more frequently and low-impact, low-variance items are less frequent. Consider creating a chart like this to keep your timelines straight:

Here we have Revenue Planning and Cash forecasting as two high-frequency items because of their importance, while other line-items with varying frequency.

How long should your planning horizon be?

Many companies stick with reforecasting the current year. This is usually still relevant when you’re looking at a 3+9 (Jan-Mar Actuals + Apr-Dec Forecast) or a 4+8, but how useful is it when you start to get to 7+5 and 8+4? You usually haven’t created the annual budget for next year by then and your planning period is ignoring Q1 of the following year. Moreover, if you were able to plan for 12 months heading into the year, why reduce it down to an arbitrary 3 or 4 now? I recommend 12 months rolling forecast minimum as a standard. That said, it really depends on your business. If you can plan with a rolling 18 months with reasonable accuracy and knowing that far in advance provides actionable insights, you should do that. Shorter than 12 months may be appropriate as well. The key is that the planning horizon is long enough for you to make and carry out tactical changes to the business within the timeframe.

Here to Stay

Rolling forecasts and frequent reforecasting can be become as prevalent as the annual budgeting process, and I expect the COVID-19 virus has just catapulted this into the forefront. As FP&A teams continue to mature and embrace FP&A software, and as the vendors themselves refine their offerings and make them even easier to use, rolling forecasts and frequent reforecasting will become a staple of every FP&A function.